Musk and DOGE face criticism for seeking access to IRS data

Clip: 2/18/2025 | 7mVideo has Closed Captions

Musk and DOGE face new criticism for seeking access to sensitive IRS data

Elon Musk’s "Department of Government Efficiency" group is seeking access to data systems within the IRS that house financial information about every taxpayer, business and nonprofit in the country. Geoff Bennett discussed the implications with Natasha Sarin, a professor at Yale Law School and School of Management and former Treasury Department counselor for tax policy and implementation.

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...

Musk and DOGE face criticism for seeking access to IRS data

Clip: 2/18/2025 | 7mVideo has Closed Captions

Elon Musk’s "Department of Government Efficiency" group is seeking access to data systems within the IRS that house financial information about every taxpayer, business and nonprofit in the country. Geoff Bennett discussed the implications with Natasha Sarin, a professor at Yale Law School and School of Management and former Treasury Department counselor for tax policy and implementation.

How to Watch PBS News Hour

PBS News Hour is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipGEOFF BENNETT: As we just heard, Elon Musk's Department of Government Efficiency group is seeking access to data systems within the Internal Revenue Service that house personal information, detailed financial information about every taxpayer, business, and nonprofit in the country.

According to The Washington Post, the IRS is considering a memorandum of understanding that would give DOGE staff members broad access to its systems.

And that is raising concern about how the sensitive information is accessed and how it might be used.

For more on the risks and implications, we turn now to Natasha Sarin, professor at Yale Law School and a former tax policy adviser at the Treasury Department.

Thanks for being here.

NATASHA SARIN, Former Treasury Department Appointee: Thanks for having me.

GEOFF BENNETT: So I want to draw on your experience at Treasury.

Help us understand what systems and what specific information these DOGE staff members could potentially access.

NATASHA SARIN: So what we're talking about here is something called the Integrated Data Retrieval System, or IDRS.

And what that data system is, is, for IRS employees, it's almost like an index of tax histories.

It is every single person, every single business in this country, their history with the agency.

So think about all the information that must be entailed in IDRS.

It is Social Security numbers.

It is personal bank account information.

It is your tax history, so how much you made and the ways in which you accrued income.

And all of that information is available to the IRS because, for example, if, during filing season, a taxpayer calls and asks the agency a question about a particular balance due or notice they have received, it's really easy for the IRS' customer service representative to pull up on the system and understand exactly what they should be telling that taxpayer.

But this data is incredibly safeguarded within the agency.

It is only accessible to people who have a specific reason for needing access to it.

They're going to interact with taxpayers and they need to be able to answer their questions.

I worked at the Treasury Department for two years.

I worked on issues related to tax credits and tax administration.

And I was nowhere near this data system.

I have polled former and current Treasury and IRS officials.

Political appointees are never near this data.

This data is so safeguarded, the IRS commissioner doesn't have access to it.

So I think it raises a lot of questions about why exactly we're even entertaining the notion of political actors from DOGE being able to have access to this type of information.

GEOFF BENNETT: So let's talk more about that.

What questions does this raise for you in terms of why these DOGE staffers want access to this information and how they might use it?

NATASHA SARIN: If you look at what the administration has been saying, there's this purported claim about waste, fraud, and abuse and wanting to make sure that fraudulent payments don't leave the government.

And I'm super sympathetic to that objective.

I think it's important for us to do more about fraud and mistaken payments.

The challenge is, I genuinely cannot come up with a reason why you might want access to IDRS that is related to fraud or some sense of mistaken payments.

The thing that I'm very worried about is, this is data that poses very significant data privacy risks to the American people.

It also -- the IRS experiences 1.4 billion cyberattacks each year, so there are real concerns about this type of data being accessed by our adversaries and being used against us.

And there are also concerns about the stability of the tax system.

We're in the middle of filing season.

Tax Day is about two months away.

What happens when one particular change in the IRS system that cascades through and means hundreds of millions of refunds aren't issued on time?

Those are the type of risks that IRS employees are worried about each day, and any potential mishandling or misuse of this data and this ecosystem really raises those risks quite significantly.

GEOFF BENNETT: What legal protections exist for people who are concerned about the very thing that you raise, that their personal, sensitive information might be improperly accessed or improperly used?

I know taxpayers who've had their information wrongfully disclosed are entitled to monetary damages.

Is that right?

NATASHA SARIN: That's absolutely right.

And what's so interesting and important to understand here is, in a bipartisan way, Congress passed very significant protections for taxpayers and protecting taxpayer privacy and taxpayer information.

That means that mishandling this data or making this data public intentionally or unintentionally can subject you to criminal fines, but also potential imprisonment.

And there is an actual private right of action that exists, that individuals whose data is disclosed can actually sue the government or sue individuals and say, I deserve compensation for the fact that my data is out there in the world in a way that I don't want it to be.

GEOFF BENNETT: You mentioned the legal challenges.

Late yesterday, a coalition of unions and tax and small business groups, they filed suit in an effort to block DOGE access to these systems that we have been discussing.

And the plaintiffs point out a conflict of interest that this affords Elon Musk.

They write: "DOGE will also have access to records of Mr. Musk's business competitors which are held by the IRS.

No other business owner on the planet has access to this kind of information on his competitors, and for good reason."

We heard Elon Musk in the Oval Office, I think it was last week, where he said that he would be the arbiter of his own conflicts of interest.

What questions does this raise for you?

NATASHA SARIN: I'm so concerned about how we think about the importance of the separation of any sense of political involvement from our payment system and from our tax system.

Another thing that is illegal in the tax system is for the executive or anyone affiliated with the executive to direct the IRS to do anything.

You can't say, I want you to audit this type of person or I want you to not send refunds to this category of people.

And so I really am quite concerned about what we're doing and what we're saying with respect to eroding some of those very strong safeguards that exist to make sure that the stability of the system and the proper role of politics and political influence and some of these conflicts of interest that you speak to are really respected.

GEOFF BENNETT: Are those safeguards, are they norms, or are they established laws?

NATASHA SARIN: They are literally established laws.

So, Section 7217 of the code says the executive cannot direct the IRS to do any auditing of particular individuals.

No enforcement decisions can be made by anyone who has a political affiliation in the administration.

And, again, those rules exist for good reason.

We have lived through the history of having our tax system and more generally our law enforcement system weaponized in ways that are disruptive to the rule of law and that are disruptive to our democracy.

And I just hope we're not at such a moment again.

GEOFF BENNETT: Natasha Sarin, thanks so much for sharing your insights with us.

NATASHA SARIN: Thanks so much for having me.

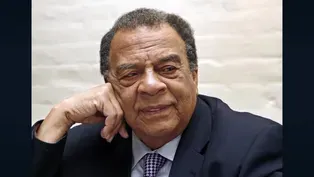

Andrew Young on the political moment and his life of service

Video has Closed Captions

Andrew Young on the current political moment and his life of service (8m 28s)

Arizona AG discusses lawsuit challenging Musk's power

Video has Closed Captions

Arizona attorney general discusses lawsuit challenging Musk's power as unelected official (6m 49s)

Examining the truth about fighting fires in California

Video has Closed Captions

Examining the truth about fighting fires in California amid water management claims (5m 58s)

Toronto crash and FAA layoffs add to air safety concerns

Video has Closed Captions

Toronto plane crash and FAA layoffs add to air safety concerns (6m 26s)

U.S. and Russia meet to discuss ending Ukraine war

Video has Closed Captions

Without Ukrainian officials present, U.S. and Russia meet to discuss ending war (3m 24s)

U.S. foreign policy experts analyze talks to end Ukraine war

Video has Closed Captions

U.S. foreign policy experts analyze the opening talks to end Russia's war in Ukraine (7m 54s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipMajor corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...